Will integrated payments help your business grow?

Posted 30 March 2021 in , Business and Marketing, TM3 News, Events

In the healthcare and fitness industries, integrated payments have become a fundamental element in helping businesses of all disciplines, sizes and shapes succeed. But, as a private practice or studio owner, you may still rely on traditional, offline payment methods, such as cash post-appointment or class. There could be a number of reasons for your hesitation in the roll-out of integrated payments including a fear of low-adoption from your client base. However, the impact of COVID-19 has accelerated the shift in payment preferences, partly because of convenience, and partly because of the advice and emphasis to avoid physical cash where possible. Regardless of the reasoning, integrated payments are not disappearing, and are only going to increase in popularity over the years to come.

More so, online payments offer a wide array of other business benefits. If you seriously want to grow your healthcare or fitness business and recoup the losses incurred in 2020, integrated payments are the only way forward.

Let’s explore the four main ways that accepting payment at the point of booking will make help your business grow this year:

1. Expanded Client Base

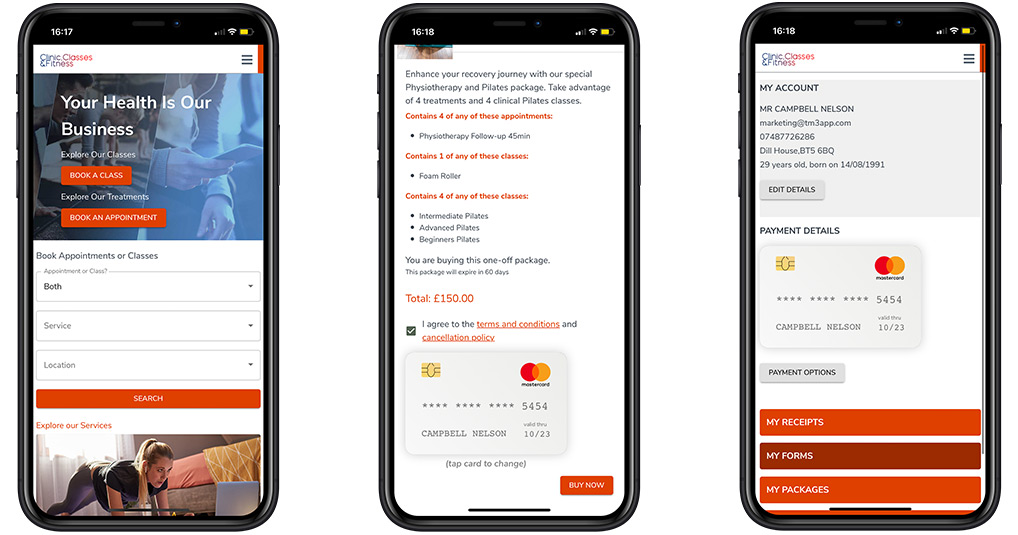

When you accept digital payments via your TM3 Connect bookings site or app, you will expand your customer base to include far more people than before - encompassing those who want to pay offline and those who prefer online payment. Your clients will often have a preferred payment method. Accepting multiple payment methods such as online card payments, payment by SMS link and in-person cash, will allow you to attract a wide range of people with different preferences.

Accepting online payments also makes it simpler to target clients who prefer virtual services. These days, many businesses offer a range of virtual services such as Physiotherapy and Virtual Classes, and you too can be a part of this trend by accepting online payments. Just think, without integrated payments – how easy would it be for you to collect payment for your virtual services?

Looking at global statistics, you’ll find that 4.6 billion people are connected to the internet, and more than 72% of these users made an online purchase in 2020. Now we’re not saying that by opening your business to online payments that all 4.6bn will become potential clients but you’ll certainly be widening your pool of potential clients.

2. Improved Trust

Clients will feel confident and more comfortable making payments on a secure site, customised to your branding where they feel a sense of familiarity.

Through your TM3 Connect client portal, your clients will be able to access your branded client portal to make payments for appointments, classes, packages and subscriptions. Giving them peace of mind that the funds are going to the right place. This increased brand security strengthens client confidence in your business and will lead to increased sales.

3. Enhanced Client Satisfaction

The online payment process is easy, quick, and most importantly it’s convenient. Clients can make payments instantly and you can offer every client their preferred payment type. There is no need to count cash or deal with paperwork. Payments can be made from any location, any devices, at a time that suits your client, catering to their craving for a streamlined payment process and instant confirmation of appointment.

Overall, online payments greatly enhance the client experience. It’s well known that a happy client becomes a repeat client, who will remain loyal to your brand and return to do business with you again in the future. These clients are also more likely to turn into advocates and may refer their friends and spread the word about your services – driving organic growth and enhanced revenue.

Increasing client satisfaction also helps your business grow by reducing online booking abandonment. According to a recent study, 27% of people abandon their online booking processes due to a complicated checkout process. The streamlined payment process provided by TM3 Connect will minimise this by capturing only the required information to confirm an appointment and then automatically sending a client registration form to collect the rest of the client information post-booking.

4. Reduced Expenses

There are lots of expenses involved in dealing with cash and offline payments. Firstly, you have to deal with a lot of paperwork – for example, invoices and bills need to be printed. You also have to deal with collecting cash and depositing it in your bank account, along with the associated business bank fees (which tend to be much higher than online payment processing fees).

Meanwhile, cash can be easily lost or stolen, which can prove very expensive to business owners. Large amounts of cash also require secure storage at all times.

All cash has to be managed and accounted for manually, whereas every online transaction is recorded automatically in TM3 and can viewed in your financial reporting suite. The online payment process ensures that no money can be lost or stolen along the way, and expenses stay at a minimum.

Integrated payments are secure, easy, and less expensive than traditional offline payment methods, making your business more efficient, productive, and profitable. Begin accepting online payments with TM3 Connect today and watch your healthcare or fitness business grow to new heights. Get a personalised quote for TM3 Connect by clicking here.

Posted 30 March 2021 in , Business and Marketing, TM3 News, Events

Recent Posts

Related Posts

- JOIN THIS YEARS TM3 TRAINING ACADEMY 9 August 2021

- HEALTHCARE COVID RECOVERY SURVEY 9 August 2021

- HELPING YOU BACK TO BUSINESS WITH PAYG PRICING 1 July 2021

- GET PAID QUICKER WITH SMS PAYMENT LINKS ON TM3 9 June 2021

- SMS COMMUNICATIONS - MORE THAN JUST A TEXT MESSAGE 1 June 2021

- TRANSFORMING HEALTHCARE AND FITNESS SERVICES WITH SUBSCRIPTIONS 20 May 2021

- CREATING ENTICING INTRODUCTORY OFFERS TO ATTRACT NEW CLIENTS 7 May 2021

- BRANDING FRAMEWORK FOR YOUR HEALTHCARE OR FITNESS BUSINESS 15 April 2021

Categories

Follow Us