The acceleration of a cashless society and integrated payments

Posted 21 January 2021 in , Business and Marketing, TM3 News

Over the last 10 months, COVID-19 has changed society as we know it. From the workplace, to the classroom and consumer spending - anything digital has seen rapid acceleration. Online bookings and virtual appointments/classes are obviously not new trends, however lockdowns have necessitated participation from even their biggest opponents. Increased awareness and wider acceptance will have a meaningful and lasting impact on these services likely well beyond the current pandemic.

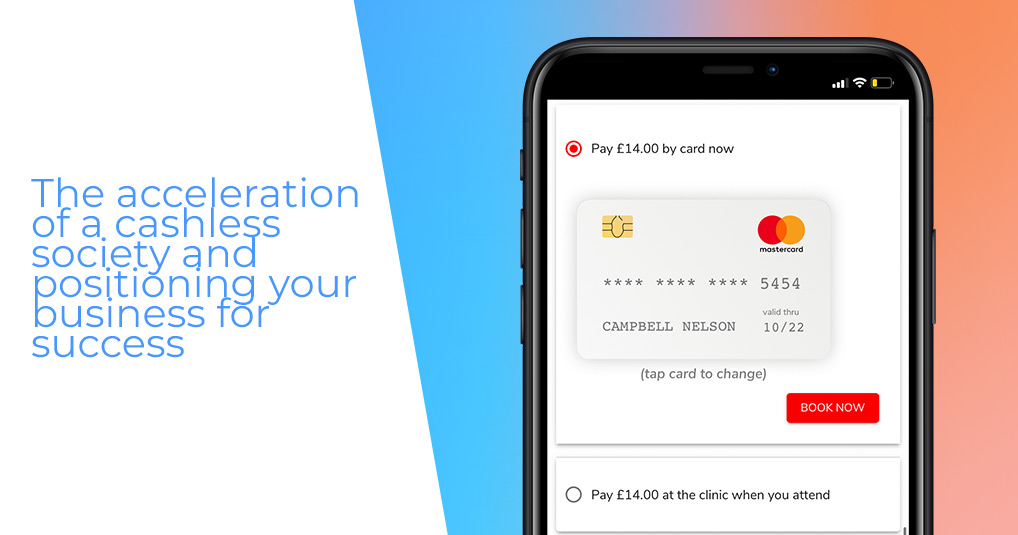

Hidden behind these developments is another digital trend: digital payments. Slowly but surely, many economies are increasingly moving away from cash payments. Once upon a time the concept of a cashless society may have sounded like it was straight from a Hollywood science fiction movie, but the acceleration of e-commerce, flexibility of banking and the growing number of ‘no cash accepted’ signs in physical shops has left purses a little empty, with the exception of debit or credit cards.

What does the future hold for payments?

Despite the direction society is heading, no society exists yet that is entirely cash-free. Like with most things, there are front-runners and early adopters, those who are on the cusp of becoming a fully-digital society when it comes to payments. Sweden is an interesting example, where cash withdrawals have been declining by around 10% each year.

Rewinding back to 2019, just 1% of Sweden’s GDP was made up of cash transactions and whilst it’s inevitable that some industries will struggle to adapt to digital payments, it’s important to note that fitness and healthcare bookings increased by 4% in the same period. Infact, the allied health and fitness industries have experienced average growth of 4% each year that cash transactions have declined in Sweden. Coincidence? We think not.

So, all of this got us thinking, how can you ensure your business is best placed for dealing with digital transactions as cash payments become few and far between?

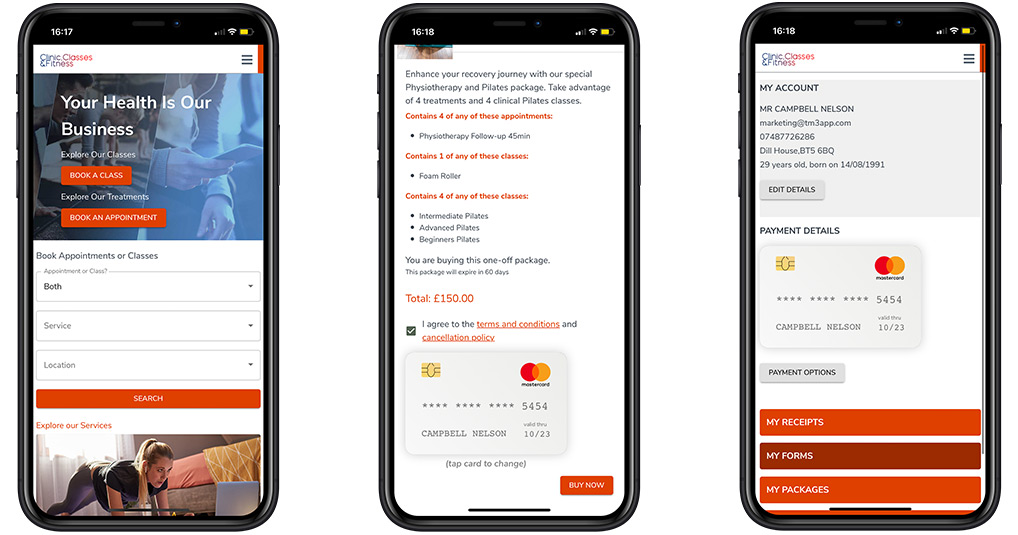

Integrated Payments on TM3 Connect

As society progressively phases out cash transactions and your clients embrace the self-service, swift checkout mindset. We want to ensure that your business has all the tools required to thrive.

With TM3 Connect, you can seamlessly accept digital and contactless payments without the need for a second phoneline or card reader - essentially increasing revenue whilst reducing overheads. Clients can store their preferred payment card on their Connect account for payment online. Additionally, your reception staff can debit their saved card upon completion of appointment, class or session, send payment links in SMS/emails and automate debt-chasing messages for online payment when a payment fails.

If you would like to know more about integrated payments on TM3 and how we can help you deliver low-touch in-person experiences as well as enhancing your digital services, click here to discuss your requirements.

Posted 21 January 2021 in , Business and Marketing, TM3 News

Recent Posts

Related Posts

- JOIN THIS YEARS TM3 TRAINING ACADEMY 9 August 2021

- HEALTHCARE COVID RECOVERY SURVEY 9 August 2021

- HELPING YOU BACK TO BUSINESS WITH PAYG PRICING 1 July 2021

- GET PAID QUICKER WITH SMS PAYMENT LINKS ON TM3 9 June 2021

- SMS COMMUNICATIONS - MORE THAN JUST A TEXT MESSAGE 1 June 2021

- TRANSFORMING HEALTHCARE AND FITNESS SERVICES WITH SUBSCRIPTIONS 20 May 2021

- CREATING ENTICING INTRODUCTORY OFFERS TO ATTRACT NEW CLIENTS 7 May 2021

- BRANDING FRAMEWORK FOR YOUR HEALTHCARE OR FITNESS BUSINESS 15 April 2021

Categories

Follow Us